The Company has established an Internal Audit Unit in

accordance with POJK No. 56/POJK.04/2015 on the

Establishment and Guidelines for the Preparation of the

Internal Audit Unit Charter and Stock Exchange Listing

Regulations.

The Internal Audit Unit serves as a part of internal control,

which in general aims to help management realize its targets

through an adequacy examination of the implementation of

internal control processes, risk management, and corporate

governance.

APPOINTMENT AND DISMISSAL OF THE HEAD OF THE INTERNAL AUDIT UNIT

The appointment and dismissal of the Head of the Internal

Audit Unit has been regulated in the Company's Internal

Audit Unit Charter. Based on the Internal Audit Unit Charter,

the head of the Internal Audit Unit work unit is appointed

and dismissed by the President Director with the approval

of the Board of Commissioners and reported to the OJK.

PROFILE OF THE HEAD OF INTERNAL AUDIT

Based on the Decree of the Board of Directors No. 002/SM/

SKDIR/VI/2022 dated June 30, 2022 and the Approval Letter

of the Board of Commissioners No. 001/SP-DEKOM/VI/2022

dated June 28, 2022, the Company appointed Joni Susanto

Agus as the Head of the Internal Audit Unit. In 2024, there

was no change in the Head of the Company's Internal Audit

Unit.

Joni Susanto Agus

Head of the Internal Audit Unit

Term of Office: Since June 28, 2022 |

Joni Susanto Agus

Head of the Internal Audit Unit

Term of Office: Since June 28, 2022 |

| Age |

42 years old |

| Citizenship |

Indonesian |

| Domicile |

Semarang |

| Legal Basis of Appointment |

The Board of Directors Decree No: 002/SM/SKDIR/VI/2022 dated June 30, 2022, and The Board of Commissioners Approval No: 001/SPDEKOM/ VI/2022 dated June 28, 2022

|

| Education Background |

Bachelor of Economics from Sekolah Tinggi Ilmu Ekonomi IBiI (2004) |

| Career Experience |

-

He started his carreer as Corporate Internal Audit Staff – Junior Manager at PT Indofood Sukses Makmur (2004 - 2011)

-

Business Analyst Manager at PT Tirta Sukses Perkasa (2018)

Public Company:

-

Staff up to Junior Manager Corporate Internal Audit at PT Indofood Sukses Makmur Tbk (2004 – 2011)

-

Corporate Internal Audit Middle Manager at PT Indofood CBP Sukses Makmur Tbk (2012 – 2018)

-

Business Analyst Manager at PT Tirta Sukses Perkasa (2018)

-

Head of Internal Audit of PT Medikaloka Hermina Tbk (2018 – 2020)

-

Internal Audit Manager at PT Industri Jamu Dan Farmasi Sido Muncul Tbk (2021 – June 2022)

|

| Concurrent Position |

None |

| Share Ownership |

None |

| Affiliation |

Not affiliated with members of the Board of Commissioners, members of the Board of Directors or with shareholders. |

| Certification |

Qualified Internal Auditor (QIA) from Yayasan Pendidikan Internal Audit |

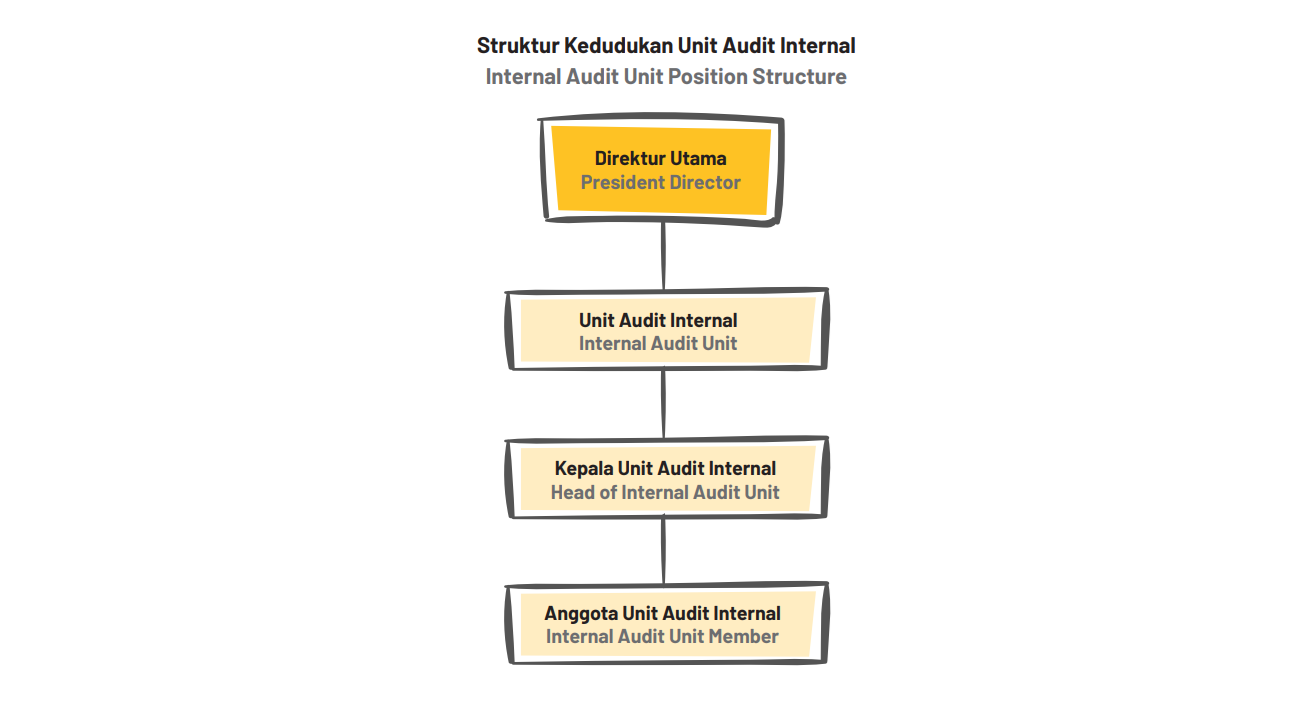

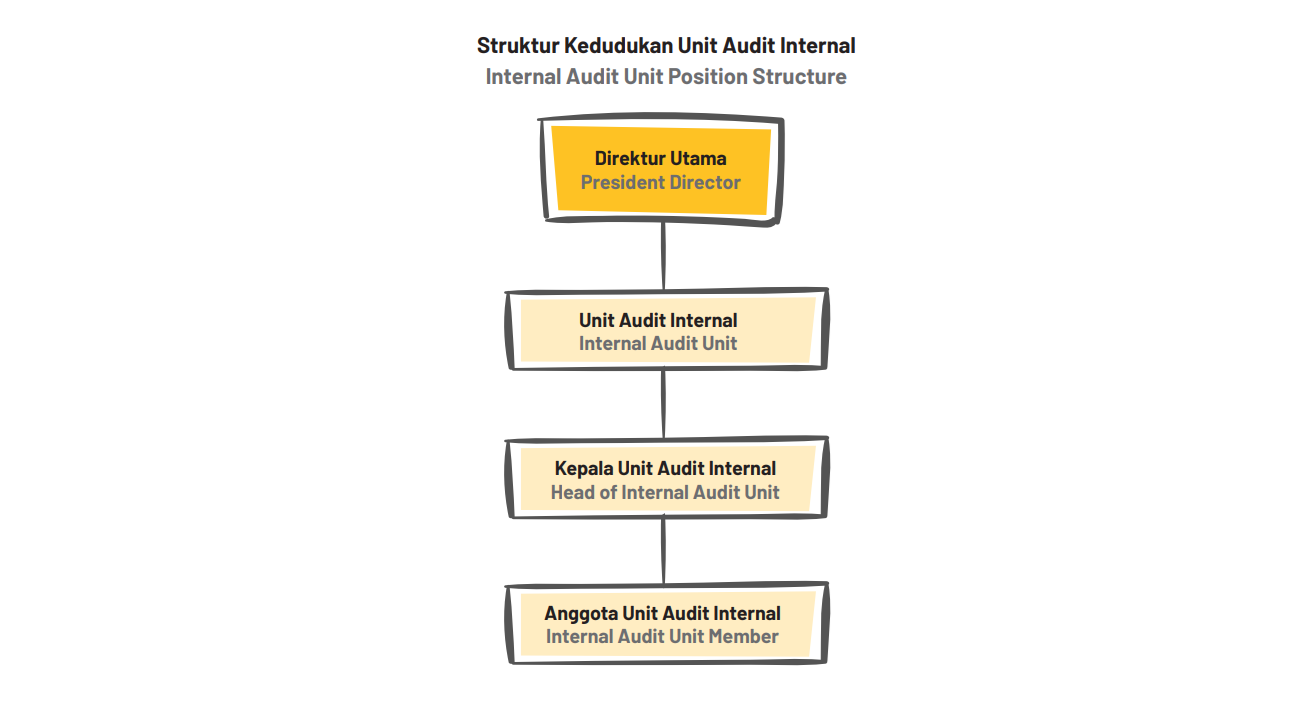

ORGANIZATIONAL STRUCTURE AND POSITION OF THE INTERNAL AUDIT UNIT

Structurally, the Internal Audit Unit provides accountability

reports to the President Director and functionally has

direct communication access to the Audit Committee to

cooperate, coordinate, and deliver information related to

the implementation and results of the audit. Additionally, the

Internal Audit Unit has access to communicate with all units

within the Company to request information, clarification,

and files or reports related to internal audit activities.

In 2024, the Internal Audit Unit had 5 (five) personnel,

consisting of 1 (one) Head of the Internal Audit Unit and 4

(four) members.

PROFESSIONAL EXPERTISE AND REQUIREMENTS

Based on article 6 of POJK No. 56.POJK.04/2015,

requirements for the Company's Internal Audit Unit are as

follows:

-

Have integrity and behavior that is professional,

independent, honest, and objective in carrying out its

duties;

-

Have knowledge and experience regarding audit

techniques and other disciplines relevant to its field of

work;

-

Have knowledge of laws and regulations in the capital

market and other related laws and regulations;

-

Have the ability to interact and communicate both

verbally and in writing in an effective manner;

-

Comply with professional standards issued by the

internal audit association;

-

Comply with the internal audit code of conduct;

-

Shall maintain the confidentiality of Company

information and/or data related to the implementation

of Internal Audit duties and responsibilities, unless

required by laws and regulations or a determination/

decision of justice;

-

Understand the principles of good corporate governance

and risk management; and

-

Willing to continuously improve their knowledge,

expertise and professionalism.

INTERNAL AUDIT UNIT PROFESSIONAL CERTIFICATION

The Company's Internal Audit Unit is provided with facilities

in the form of a systematic and tiered competency

development program. The program is carried out by

involving internal auditors in the certification program. In

2024, the Internal Audit Unit Member who has expertise

certification is 1 (one) person, or 20% of the total number of

Internal Audit Unit employees, which is 5 (five) people.

The certification held by members of the Internal Audit Unit is:

- Qualified Internal Auditor (QIA) from the Internal Audit Education Foundation, by Joni Susanto Agus

Furthermore, the Company is committed to continuously

improving the quality of internal audits within the Company

by gradually increasing the certification level of Internal

Audit Unit employees over the next few years.

INTERNAL AUDIT UNIT CHARTER

In carrying out its functions, the Internal Audit Unit adheres

to the Internal Audit Charter issued on June 18, 2013 and last

updated on June 28, 2022. The Internal Audit Unit Charter

contains the following:

- Definition;

- Mission;

- Objectives;

- Core Principles;

- Structure and Position;

- Membership;

- Internal Auditor Requirements and Qualifications;

- Scope;

- Duties and Responsibilities;

- Authorities;

- Independence, Objectivity, and Professionalism;

- Competence, Due Professional Care, and Continuing Professional Development;

- Code of Conduct; and

- Reporting Activities

Download: Internal Audit Charter 2022 (PDF, 11MB)

DUTIES AND RESPONSIBILITIES OF THE INTERNAL AUDIT UNIT

Duties and responsibilities of the Internal Audit Unit are as follows:

-

Create an annual audit plan based on risk, annual staff

plan and needs and the Internal Audit Unit budget

for approval by the President Director and the Audit

Committee. If there are significant changes to the plan

that has been submitted, the Head of Internal Audit

must submit the changes along with the revised plan to

the President Director and the Audit Committee;

-

Assess the adequacy, test, and evaluate the internal

control mechanism and risk management system in

accordance with Company policy;

-

Assess the effectiveness and efficiency of control

procedures implemented in finance, accounting,

operations, human resources, marketing, and

information technology and other activities;

-

Provide suggestions for improvement and objective

information on activities audited at all levels of

management;

-

The Internal Audit Unit is responsible for submitting

reports on audit activities and findings to the President

Director and the Board of Commissioners through the

Audit Committee;

-

Monitor, analyze, and report on the implementation of

follow-up improvements that have been suggested;

-

The Internal Audit Unit cooperates with the Audit

Committee so that the Audit Committee can carry out

its role in accordance with applicable regulations;

-

Prepare a program to evaluate the quality of internal

audit activities;

-

Conduct special audit if necessary;

-

The Internal Audit Unit is responsible for carrying out

ad-hoc assignments given by the President Director or

the Audit Committee as long as they do not contain any

conflict of interest;

-

The Head of Internal Audit must assess the skills,

understanding, and knowledge of audit staff in relation

to the audit work to be carried out. If the Internal Audit

Unit does not have adequate skills, understanding,

and knowledge for a particular matter, the Head of the

Internal Audit Unit must report to the President Director

and the Audit Committee to then appoint an independent

third party.

Periodically, the implementation of the Internal Audit Unit's

duties is evaluated and improved by adjusting to the internal

control system, risk management and corporate governance

so that the Company can achieve its goals effectively and

efficiently.

IMPLEMENTATION OF THE INTERNAL AUDIT UNIT DUTIES IN 2024

As of December 31, 2024, the Internal Audit Unit has carried out the following duties:

-

Implementing the annual Internal Audit Plan;

-

Reviewing the effectiveness of the internal control

system, risk management system and corporate

governance practices, and evaluate the efficiency and

effectiveness of the Company's operations;

-

Submitting and discussing internal audit reports to

the Audit Committee, Board of Directors, and senior

management;

-

Monitoring and ensuring that corrective actions have

been implemented correctly and in a timely manner by

management.